If you’re chasing adrenaline in the market, this isn’t your lane. The appeal of 5starsstocks.com staples sits in the opposite direction: boring companies, predictable demand, and returns that don’t need hype to work. That’s not a flaw. It’s the point. Investors who pay attention here tend to sleep better, and they’re often the same ones still standing when trend-driven portfolios crack.

The conversation around 5starsstocks.com staples keeps circling back to one idea: stability beats excitement over time. That stance won’t win arguments on social media, but it wins balance sheets.

Why staples earn attention when markets lose discipline

When markets slide or stall, capital moves with intention. It doesn’t run toward the loudest story. It runs toward revenue that keeps showing up. Consumer staples companies sell things people don’t stop buying just because inflation spikes or GDP stalls. Groceries, household goods, personal care—these are habits, not discretionary splurges.

What makes 5starsstocks.com staples interesting is how this reality is filtered through a rating-driven research platform. The focus isn’t on speculative upside. It’s on earnings consistency, debt control, and the kind of pricing power that survives pressure. That alone sets it apart from platforms that reward volatility masquerading as opportunity.

This matters because defensive capital isn’t passive capital. It’s strategic. Investors rotate into staples when they expect turbulence or stagnation, not because they’re scared, but because they’re realistic.

How rating-driven platforms shape staples selection

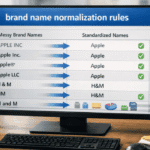

The value of 5starsstocks.com staples isn’t the sector itself. The sector has existed forever. The difference lies in how companies are surfaced and compared. Rating systems force discipline. They punish erratic earnings and reward operational restraint.

That approach naturally favors staples businesses with long operating histories and clear cost structures. Brands that control shelf space. Companies that manage logistics well. Firms that can raise prices without losing customers. These traits don’t show up in hype cycles, but they dominate long-term charts.

The ratings also discourage emotional investing. When every stock is reduced to a clear score, the conversation shifts from stories to numbers. That’s uncomfortable for traders chasing momentum. It’s productive for investors who care about durability.

Dividends are not the headline, but they matter

Dividend talk often gets sloppy. Yield alone means nothing if it isn’t supported by cash flow. What stands out in 5starsstocks.com staples coverage is how dividends are treated as a consequence of business health, not a marketing hook.

Staples companies that pay consistent dividends tend to share one trait: boring predictability. Their margins aren’t flashy, but they’re reliable. Their capital spending is controlled. They don’t gamble on expansion sprees that jeopardize payouts.

For income-focused investors, this discipline matters more than headline yield. A modest dividend that survives downturns beats a generous one that vanishes when conditions tighten. Platforms that highlight this difference earn trust.

Staples versus growth isn’t a fair fight

Comparing staples to growth stocks misses the point. They’re solving different problems. Growth promises acceleration. Staples promise continuity. The mistake investors make is treating them as competitors rather than complements.

5starsstocks.com staples tend to appeal during moments when growth narratives start to fray. Rising interest rates, supply chain stress, margin compression—these environments expose fragile business models. Staples feel dull until everything else feels fragile.

That’s when defensive allocation stops being optional. It becomes insurance. Not against loss, but against panic-driven decisions that lock in loss.

The transparency question investors should not ignore

No platform deserves blind trust. One criticism often raised around 5starsstocks.com staples coverage is transparency. Ratings are algorithm-driven, and the exact weighting isn’t always public. That doesn’t make them useless, but it does mean investors should treat them as filters, not verdicts.

Smart use of any rating platform involves verification. Look at the balance sheet. Check revenue stability across cycles. Compare debt ratios. Ratings speed up the process; they don’t replace judgment.

Ignoring this step turns research into outsourcing responsibility. That’s how people blame tools instead of decisions.

Why staples appeal to long-horizon investors

Time changes how risk feels. Short-term traders experience volatility as opportunity. Long-term investors experience it as noise. 5starsstocks.com staples cater to the second mindset.

These businesses don’t need perfect timing. They need patience. Revenue grows slowly. Market share shifts gradually. Brand strength compounds quietly. Over a decade, that restraint matters more than short bursts of excitement.

This is why staples often anchor retirement portfolios and institutional allocations. They aren’t designed to impress quarterly. They’re built to endure.

Sector rotation and the quiet role of staples

Market cycles don’t announce themselves. They creep in. Smart investors rotate before narratives change, not after headlines confirm them. Staples often receive attention late because they lack drama. That delay creates opportunity.

5starsstocks.com staples highlight companies that benefit when consumers pull back on discretionary spending. When travel slows and gadget upgrades pause, grocery receipts don’t disappear. That revenue resilience becomes visible only after stress arrives.

Investors who wait for confirmation usually pay higher prices. Those who rotate early benefit from stability when it’s most valuable.

Not all staples deserve equal confidence

The word “staples” can lull investors into complacency. Not every company in the sector is well-run. Cost inflation, poor inventory management, and weak branding still destroy value here.

This is where disciplined screening matters. 5starsstocks.com staples rankings aim to separate efficient operators from laggards. Companies that pass rising costs to consumers without volume collapse stand apart. Those that rely on discounting signal weakness.

Blindly buying the sector misses these distinctions. Research platforms exist to enforce them.

The real use case: portfolio ballast, not excitement

Anyone using 5starsstocks.com staples as a thrill-seeking tool is doing it wrong. The real benefit is ballast. These holdings steady portfolios when other bets misfire. They reduce the emotional load of investing.

That psychological advantage is underappreciated. Investors who aren’t constantly stressed make better decisions. They hold through downturns. They rebalance instead of reacting. Staples play a quiet role in that behavior shift.

This isn’t theory. It’s observable in how experienced investors allocate capital as they age.

Where critics miss the point

Critics often dismiss staples as low-return relics. That critique assumes markets reward only speed. History disagrees. Many staples companies outperform over long horizons precisely because they avoid destructive risk.

The same critics often chase complexity while underestimating execution. Running a global consumer staples operation efficiently for decades isn’t easy. It’s just less visible than a tech launch.

Platforms that spotlight this discipline, including 5starsstocks.com staples analysis, push back against the myth that boring equals obsolete.

The discipline test investors rarely apply

A simple test exposes investor intent. Ask whether you’d still want the stock if headlines disappeared for five years. Staples usually pass. Trend stocks rarely do.

That’s why staples reward conviction rather than attention. They don’t need constant monitoring. They need periodic review. That distinction frees mental bandwidth for better decisions elsewhere.

Using 5starsstocks.com staples as a screening layer helps enforce that discipline. It nudges investors toward companies that reward patience, not obsession.

A clear takeaway for serious investors

The appeal of 5starsstocks.com staples isn’t mystery or novelty. It’s restraint. In a market addicted to speed, restraint becomes an edge. Staples won’t make you feel clever. They’ll make you consistent. And consistency is what compounds.

If your portfolio feels exciting every week, it’s probably fragile. If it feels dull and predictable, you’re likely doing something right.

FAQs

What type of investor benefits most from 5starsstocks.com staples coverage?

Long-term investors who value steady returns, lower volatility, and income consistency tend to benefit the most.

Should staples replace growth stocks in a portfolio?

No. Staples work best as a stabilizing layer, not a full replacement for growth exposure.

How often should staples holdings be reviewed?

Periodic reviews tied to earnings reports or macro shifts are enough. Constant monitoring adds little value.

Do staples still perform during high inflation?

Strong staples companies often pass costs to consumers, preserving margins better than discretionary businesses.

Is relying on ratings alone a mistake?

Yes. Ratings speed up research, but final decisions should include balance sheet and cash flow review.