People defend payday loans eloanwarehouse because speed feels like mercy when bills stack up. I don’t buy that defense. Speed without restraint is how bad financial decisions slip past common sense. The problem isn’t that these loans exist. The problem is how quietly they drain people who already have no room for mistakes.

When readers ask whether payday loans eloanwarehouse are worth considering, the honest answer depends less on marketing promises and more on how much damage someone can absorb if things go wrong. And they often do.

The real appeal is not convenience, it’s desperation

Why borrowers overlook the cost

Payday loans eloanwarehouse attract people who already know banks won’t help them. That matters. The decision is rarely casual. It usually happens after rent is late, the car won’t start, or a utility shutoff notice lands on the kitchen table.

The appeal comes down to three things:

- Approval feels quick and personal

- Credit checks don’t block the door

- Monthly payments sound manageable on paper

That last point is where trouble starts. Installments soften the psychological hit, even when the total cost balloons. Payday loans eloanwarehouse lean heavily on this structure, and it works because people think in months, not totals.

Installments don’t make debt safer

Stretching repayment across months doesn’t reduce risk. It spreads it. Borrowers stay exposed longer, and one missed payment can trigger fees that undo weeks of progress. With payday loans eloanwarehouse, the danger isn’t one bad month. It’s a bad sequence.

The pricing problem no one wants to say out loud

High APRs change behavior

Interest rates tied to payday loans eloanwarehouse aren’t abstract numbers. They shape how borrowers act. When payments eat a large chunk of each paycheck, people stop planning. They react.

That reaction usually looks like:

- Skipping other bills

- Borrowing again before the first loan ends

- Letting automatic withdrawals overdraw accounts

Once that cycle starts, escape requires either outside money or serious income changes. Hoping things “even out” rarely works.

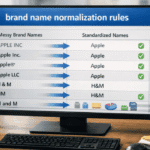

Transparency gaps aren’t accidents

Loan terms exist, but clarity is another story. With payday loans eloanwarehouse, borrowers often understand the payment amount while underestimating the full cost. That gap isn’t random. It’s structural.

Clear pricing discourages impulse borrowing. Ambiguity invites it.

Customer complaints follow a predictable pattern

Where frustration usually begins

Reviews tied to payday loans eloanwarehouse repeat the same frustrations. Not isolated complaints. Patterns.

Most start with confusion around withdrawals. Payments hit earlier than expected. Amounts differ slightly from what borrowers remember agreeing to. Those differences matter when accounts are already thin.

Collections change the tone fast

Borrowers also report a sharp shift once payments slip. Friendly verification calls turn firm. Then aggressive. Payday loans eloanwarehouse don’t need to break laws to apply pressure. They only need leverage.

That leverage comes from access to bank accounts and tight financial margins.

Legal scrutiny isn’t noise, it’s context

Lawsuits reflect structural tension

Legal challenges around payday loans eloanwarehouse don’t come from nowhere. They point to a larger tension between state lending limits and how certain lenders operate across jurisdictions.

Consumers don’t need legal training to feel the impact. They feel it when protections they assumed applied don’t.

Borrowers pay for regulatory gray areas

When lenders operate near the edges of regulation, risk shifts downstream. Borrowers absorb uncertainty through fees, disputes, and limited recourse. Payday loans eloanwarehouse sit squarely in that zone.

Comparing alternatives requires honesty, not optimism

Credit unions are boring for a reason

People dismiss credit unions because the process feels slow. That slowness protects borrowers. Lower rates, clear terms, and fewer surprises make mistakes less punishing.

Compared to payday loans eloanwarehouse, even small personal loans from community lenders reduce long-term harm.

Employer advances beat commercial debt

Earned wage access or employer advances don’t solve income problems, but they avoid compounding them. They also don’t escalate when something goes wrong.

That difference matters more than convenience.

When people still choose payday loans eloanwarehouse

Short-term fixes with strict limits

There are narrow cases where payday loans eloanwarehouse don’t explode into disasters. They require discipline most borrowers don’t realistically have.

Those cases include:

- Stable income with no upcoming disruptions

- Clear payoff plan within weeks, not months

- No reliance on overdraft-prone accounts

That list is shorter than marketing suggests.

What makes these loans dangerous for repeat use

The moment payday loans eloanwarehouse become a habit, they stop functioning as a bridge and start acting like a tax. Each new loan funds the last one’s damage.

At that point, the problem isn’t cash flow. It’s structural dependence.

What informed borrowers do differently

They calculate totals, not payments

Smart borrowers ignore monthly numbers and focus on total repayment. That single shift exposes the true cost of payday loans eloanwarehouse faster than any warning label.

They assume something will go wrong

Budgets fail. Hours get cut. Cars break. Planning for perfect months is how people get trapped. Anyone considering payday loans eloanwarehouse should plan for disruption, not stability.

Why marketing language deserves skepticism

“Flexible” often means unforgiving

Flexibility sounds friendly until deadlines hit. With payday loans eloanwarehouse, flexibility usually applies at signup, not repayment.

Speed hides commitment

Fast approvals feel empowering. They’re also how long-term obligations slip past resistance. Once money lands, the contract stops feeling theoretical.

The larger impact rarely gets discussed

Community drain adds up

High-cost lending pulls money out of local economies. Each dollar spent on interest isn’t spent at nearby businesses. Payday loans eloanwarehouse don’t just affect individuals. They thin entire communities over time.

Normalizing emergency debt lowers standards

When payday loans eloanwarehouse become normal, expectations drop. Employers feel less pressure to raise wages. Systems rely on debt to patch income gaps.

That’s not accidental. It’s convenient.

What people should ask before borrowing

Before signing anything tied to payday loans eloanwarehouse, borrowers should answer questions most marketing avoids:

- What happens if income drops next month?

- How many payments can I miss before penalties hit?

- What is the total dollar cost, not the monthly number?

- How hard is it to stop automatic withdrawals?

If those answers feel uncomfortable, that discomfort is the point.

Final take

Payday loans eloanwarehouse don’t ruin lives overnight. They do it slowly, through fees that feel small, payments that feel manageable, and optimism that rarely survives real life. Anyone considering them should stop treating speed as a benefit and start treating it as a warning.

Fast money is never neutral. It always chooses a side.

FAQs

- Can borrowers cancel payday loans eloanwarehouse shortly after approval without penalty?

Cancellation policies exist, but timing is tight. Once funds are deposited, options narrow quickly and fees can still apply. - Do payday loans eloanwarehouse report payment history to credit bureaus?

Reporting varies and often doesn’t help borrowers. On-time payments rarely build credit meaningfully, while missed payments can still cause damage indirectly. - Are automatic bank withdrawals mandatory with payday loans eloanwarehouse?

In most cases, yes. That access is how lenders protect themselves, not borrowers. - What happens if a borrower closes their bank account during repayment?

Closing accounts often triggers immediate default actions and escalated collection efforts rather than stopping the debt. - Is refinancing possible with payday loans eloanwarehouse?

Refinancing usually means extending repayment at additional cost. It reduces pressure short-term while increasing total expense.