qlcredit didn’t get attention because it was loud or flashy. It got attention because people are tired of banks wasting their time. Long applications, unclear rejections, and systems that punish anyone without a perfect credit file pushed borrowers toward faster online options. qlcredit sits right in that space, promising speed, access, and fewer hoops. That promise is appealing. Whether it’s safe or smart depends on how closely you look.

This isn’t a cheerleading piece, and it’s not fear-driven either. The point is to examine how qlcredit operates in practice, why people use it, and where caution actually matters.

Why platforms like qlcredit attract borrowers so quickly

Speed is the first hook. Traditional lenders still rely on processes designed decades ago. Paperwork, branch visits, and rigid score thresholds slow everything down. qlcredit positions itself as an alternative that cuts that friction. Applications happen online. Decisions arrive faster. For someone facing a cash gap, that matters more than polished branding.

Accessibility comes next. A borrower with thin credit history or past missteps often hits a wall at banks. qlcredit appears to judge applicants using broader data signals. That doesn’t guarantee approval, but it changes the conversation. Instead of an instant “no,” there’s at least a review.

Convenience seals the deal. No scheduling appointments. No waiting days just to learn whether the door is closed. For users already comfortable managing finances online, qlcredit feels familiar rather than intimidating.

How qlcredit handles credit decisions behind the scenes

qlcredit leans on automated evaluation rather than human loan officers. That has real consequences. Automated systems don’t get tired, don’t care about appearances, and don’t follow personal biases. They process information fast and consistently.

The trade-off is rigidity. Once data goes in, the outcome comes out. There’s no conversation. If your profile doesn’t fit the system’s tolerance, the result won’t change because you explained your situation. That’s efficient, but it also means users need to understand what they’re agreeing to before submitting anything.

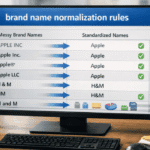

Another reality is data reliance. qlcredit appears to use more than classic credit scores. Payment behavior, income signals, and digital patterns may influence decisions. That helps some borrowers. It can also surprise others who assume a single score still runs everything.

The appeal and the danger of fast approvals

Fast approval feels good. It reduces stress. It feels like control. But speed can also push people past due diligence. qlcredit benefits from that tension. When money arrives quickly, borrowers are less likely to slow down and scrutinize repayment terms.

This is where responsibility shifts. qlcredit may provide access, but borrowers still carry the cost of repayment. Interest rates, fees, and penalties matter more than approval speed. If those details aren’t reviewed carefully, convenience turns expensive fast.

Speed itself isn’t the enemy. Blind acceptance is.

Transparency questions that deserve attention

One of the most common criticisms surrounding qlcredit isn’t about denial rates or app usability. It’s about clarity. Users expect to know who operates a platform, where it’s registered, and which rules it follows. When that information is hard to verify, trust erodes.

qlcredit has been linked in reviews to a corporate entity based in Asia, but public regulatory disclosures remain limited. That doesn’t automatically mean wrongdoing. It does mean users need to approach with eyes open.

Clear licensing, published compliance details, and direct support channels separate stable financial services from temporary operations. When those signals are weak, caution becomes rational, not paranoid.

Comparing qlcredit to traditional banks without nostalgia

Banks still dominate for long-term loans, mortgages, and large credit lines. They’re slow because they’re regulated heavily, audited constantly, and built to avoid collapse. That stability has value.

qlcredit competes in a different lane. Short-term credit, quick decisions, and digital convenience. Comparing the two directly misses the point. The real question is whether qlcredit is being used for the right reasons.

Using qlcredit as a bridge for temporary needs makes more sense than treating it like a long-term financial anchor. Problems start when short-term tools get used repeatedly without a repayment plan.

Who actually benefits most from qlcredit

The strongest use case for qlcredit isn’t emergency spending without a plan. It’s controlled borrowing with clear intent.

People who understand their cash flow.

People who know exactly when repayment will happen.

People who read terms before clicking agree.

Those users extract value from speed without falling into dependency. On the other side, borrowers already struggling with debt may find qlcredit too easy to access, which can deepen financial strain instead of relieving it.

Access alone doesn’t solve financial problems. Structure does.

Risk signals borrowers should never ignore

qlcredit, like any online credit platform, carries warning signs users should watch closely.

If customer support is slow or vague, that matters.

If repayment terms change or feel unclear, stop.

If pressure tactics appear, walk away.

The biggest red flag isn’t denial. It’s confusion. Financial agreements should feel precise, not foggy.

The broader trend qlcredit represents

qlcredit isn’t an outlier. It’s part of a shift where lending moves away from physical institutions and toward platforms. That shift isn’t reversing. What will change is regulation pressure and user awareness.

Platforms that survive long-term will be the ones that clarify their terms, strengthen compliance, and earn repeat trust. Others will fade as scrutiny increases.

qlcredit sits at that crossroads. How it evolves will determine whether it becomes established or forgotten.

Using qlcredit without letting it use you

The smartest approach to qlcredit is simple but disciplined.

Borrow only what you can repay on schedule.

Treat fast approval as a tool, not a solution.

Never assume convenience replaces responsibility.

qlcredit doesn’t force anyone to borrow. It simply removes obstacles. What happens next belongs to the user.

Final perspective on qlcredit

qlcredit reflects both the best and worst of modern digital finance. It offers access where banks hesitate. It moves fast where institutions crawl. It also demands that users bring their own judgment, because speed leaves little room for mistakes.

The real divide isn’t between banks and platforms. It’s between informed borrowers and impulsive ones. qlcredit rewards the first group and punishes the second. That reality won’t change, no matter how friendly the interface looks.

Anyone considering qlcredit should pause, read carefully, and decide whether the convenience serves a plan or replaces one. That single distinction makes all the difference.

FAQs

- Is qlcredit suitable for repeat borrowing?

It can be, but only if repayments stay predictable. Repeated use without improving cash flow increases risk quickly. - How fast do qlcredit decisions usually arrive?

Reports suggest decisions often come faster than traditional lenders, sometimes within minutes rather than days. - Does qlcredit replace the need for a credit score?

No. It may weigh additional data, but credit history still influences outcomes. - What should borrowers check before accepting a qlcredit offer?

Repayment schedule, total cost, penalties, and how customer support handles disputes. - Can qlcredit help rebuild financial stability?

Only when used deliberately. It doesn’t fix underlying issues, but it can support short-term needs when managed carefully.